Can NIKE's Athlete-Led Storytelling Strategy Win Back Market Share?

NKE doubles down on athlete-led storytelling to reignite its brand and reconnect performance, culture and consumer passion.

Predicted Price is the pryogiTM prediction of where the price is going in next 3-4 quarters. There may be a revision of the predicted price every 3 months from the date of publication of the first predicted price of the stock. Price on Report Date is the price of the stock on the day prediction was published by pryogiTM. Current price shows the current price of the stock.

Margin of error shows range the price will end up in dollars either above or below the predicted price. Margin of error percentage shows the price will end up in percentage either above or below the predicted price.

Expected Returns from report date shows the returns (positive or negative) from published prediction date if you bought the stock on report date. Expected Returns from today shows the returns from today if you buy the stock today. A positive expected returns indicates a profit you will make, a negative expected return indicates a loss you will make if you buy the stock. There are different strategies to apply in the stock market for profit and loss, pryogiTM will publish such strategies in the future to help you.

PryogiTM meter shows you predicted price, price on the date this prediction was published(report date) and price of the stock today on a price scale. This indicates if the stock price is moving towards or away from the predicted price

PryogiTM performance chart shows actual movement of stock price from prediction published date(report date) and if the price is moving towards or away from predicted price

NKE doubles down on athlete-led storytelling to reignite its brand and reconnect performance, culture and consumer passion.

Shares of Lululemon Athletica Inc. ( NASDAQ:LULU ) are trading higher Monday after a new report indicated the company signed a major sports partnership. LULU stock is racing ahead of the pack. See what is driving the movement here.

The stock market underappreciates these three stocks, which could present an opportunity for long-term investors.

These stocks offer compelling value for businesses that continue to show solid brand strength.

NKE's bold collaboration with SKIMS fuses sport and style, aiming to refresh its women's segment and reignite brand momentum.

lululemon's innovation push faces fierce competition from NIKE and Under Armour as shifting demand and pricing pressures test its premium edge.

LULU's U.S. slowdown and margin pressures test its ability to reignite growth through new product innovation and AI-driven design.

Becomes One of the Largest Six Flags Shareholders Believes Six Flags Offers Opportunity for Significant Shareholder Value Creation

The apparel brand is finally fixing what's wrong.

Shares of these retailers have been crushed this year. But there are reasons to be upbeat.

The business is facing some challenges, but it's still a high-quality cash cow.

Lululemon Athletica Inc. ( NASDAQ:LULU ) is teeing up for a comeback, with product revamps on the horizon and global momentum intact. The company is tightening for 2026-promising fresher assortments and faster pivots. BTIG analyst Janine Stichter reiterated a Buy rating on Lululemon, with a ...

Comfort Systems shines with booming data center demand, while Lululemon struggles amid slowing U.S. sales and bearish sentiment.

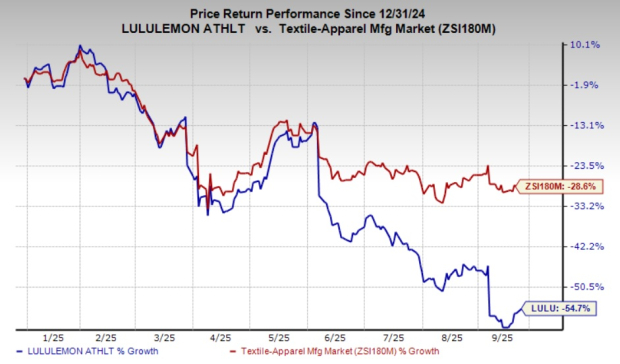

LULU shares have plunged over the last year, down nearly 50%. Weakening growth has been a major red flag.

LULU leans on surging global sales to offset North America softness, signaling a shift toward international growth.

NKE's 20% y/y rise in running signals its comeback as innovation and athlete-driven storytelling reignite consumer demand.

Which company has better long-term return potential?

Undervalued stocks are becoming more difficult to find during this bull market.

Investors shouldn't let stock performance distract them from a company's underlying fundamentals.

RL's brand elevation and steady momentum contrast with LULU's innovation push amid near-term challenges in the premium apparel space.

On Thursday, Franklin Street Advisors disclosed that it sold out its entire position in Lululemon Athletica during the third quarter in an estimated $22.8 million transaction.Franklin Street Advisors reported in a Securities and Exchange Commission filing released on Thursday that it exited its ...

Zacks highlights lululemon athletica, NIKE, and Under Armour as major players in the athleticwear market, each navigating a challenging environment through brand strength, innovation, and global strategy.

The celebration of South Asian culture with traditional and modern music and dance performances, crafts, and giveaways expands to two days

LULU beats Q2 earnings estimates and bets on design innovation and global expansion to sustain its edge in a cooling activewear market.

One of these stocks is up 500% in a single year!

NKE faces a $1.5B tariff surge, testing its margin defenses and brand loyalty, even as its "Win Now" strategy gains ground.

Tariff headwinds and weakness in its core U.S. market weighed on the athleisure leader.

Lululemon Athletica Inc's ( NYSE:LULU ) short interest as a percent of float has risen 37.74% since its last report. According to exchange reported data, there are now 9.01 million shares sold short, which is 10.22% of all regular shares that are available for trading.

These stocks face similar risks, and they're down by similar amounts over the past five years.

The leader in athleisure clothing has lost the market's confidence in 2025.

Despite the fact that this company has beat the number in each of the last four quarters, estimates are still falling.

Stocks have hit record highs recently, but that does not mean investors should step aside entirely. Here are two good ideas.

Richtech Robotics Surges on Growth Hopes While Lululemon Sees Decline.

Lululemon is going through a bad stretch, but the underlying business still shows promise.

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades, downgrades and initiations, please see our analyst ratings page.

LULU trims its fiscal 2025 outlook as tariffs, markdowns and weak U.S. demand weigh on margins and earnings momentum.

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades, downgrades and initiations, please see our analyst ratings page. Keybanc analyst Steve Barger downgraded the rating for Lam Research Corporation LRCX from ...

LULU shares hover near a 52-week low as weak U.S. trends, tariff pressures and slashed guidance weigh on investor sentiment.

Whales with a lot of money to spend have taken a noticeably bullish stance on Lululemon Athletica. Looking at options history for Lululemon Athletica LULU we detected 33 trades. If we consider the specifics of each trade, it is accurate to state that 60% of the investors opened trades with ...

With Wall Street indices hitting fresh records and the Fed embracing a dovish pivot with further rate cuts on the table, Goldman Sachs wasted no time upgrading its S&P 500 target-but it's the bank's unusual stock picks that stand out.

In five years from now, that $500 could be double, triple, or more.

Stocks may be at all-time highs, but there are still good buying opportunities out there.

Got $1,000 to invest? Two beaten-down retailers are trading well below recent norms and could reward patient buyers.

The stock trades at an incredibly low forward price-to-earnings multiple of just 12.

Lululemon is underperforming the broader market indexes in 2025.

LULU beats earnings estimates in Q2, but weak U.S. sales and slower product cycles force it to trim its fiscal 2025 guidance despite global growth momentum.

These stocks offer attractive long-term upside potential.