Jan. 6, 2026 •

Neutral

Robeco Institutional Asset Management B.V. significantly increased its stake in The Walt Disney Company (NYSE:DIS) by 86.3% in Q3, now holding over 1.5 million shares worth an estimated $180.79 million. This comes as Disney reported Q3 EPS of $1.11, exceeding estimates, despite slightly missing revenue forecasts. The company maintains a "Moderate Buy" consensus rating from analysts with an average target price of $135.94.

Jan. 6, 2026 •

Bullish

Netflix has expanded its WWE streaming partnership to include almost the entire WWE library in the United States, following the end of WWE's deal with Peacock. This new agreement builds on their previous partnership for "WWE Raw," making Netflix the official home for WWE's PLEs prior to WrestlePalooza in September 2025, alongside original programming and documentaries. The future of other promotion's libraries (WCW, ECW, etc.) within this deal remains uncertain.

Jan. 6, 2026 •

Somewhat-Bearish

CFRA analyst downgraded Netflix (NFLX) to a Hold rating with a $100.00 price target. Despite a Moderate Buy consensus rating from other analysts with a $130.45 average price target, corporate insider sentiment on the stock is negative, with increased insider selling recently. The company reported strong quarterly revenue and net profit for the quarter ending September 30.

Jan. 6, 2026 •

Neutral

CFRA downgraded Netflix (NFLX) to Hold from Buy and lowered its price target to $100, citing risks associated with Netflix's pursuit of Warner Bros. Discovery. This downgrade puts the spotlight on potential challenges like regulatory review, financing costs, and the impact on Netflix's balance sheet. Investors are awaiting Netflix's Q4 results on January 20th for clarity on deal financing and their 2026 outlook.

Jan. 6, 2026 •

Somewhat-Bearish

Conservative investors are challenging Netflix over content they perceive as child sexualization, arguing that such programming negatively impacts the company's financial performance and investor trust. The article highlights past controversies like the film "Cuties" and features in shows with young ratings, asserting that these choices betray Netflix's fiduciary duty to its shareholders. Bowyer Research, working on behalf of investors, has filed a proposal urging Netflix to explain the compatibility of such content with its financial responsibilities.

Jan. 5, 2026 •

Neutral

This article discusses the application of quantitative AI models to analyze the movement of the Netflix ETF (NFLP) for trading strategies. It identifies weak near-term sentiment for NFLP, potentially catalyzing bearish positioning, and provides specific institutional trading strategies including position trading, momentum breakout, and risk hedging with defined entry/exit points and stop losses. The analysis also includes multi-timeframe signal analysis for near-term, mid-term, and long-term horizons, highlighting support and resistance levels.

Jan. 5, 2026 •

Neutral

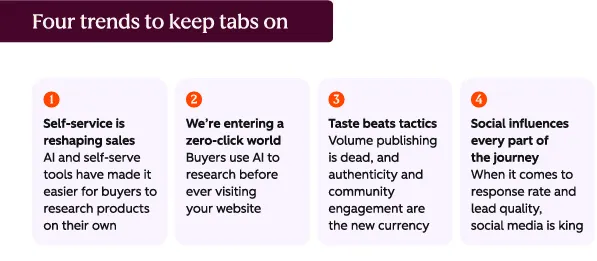

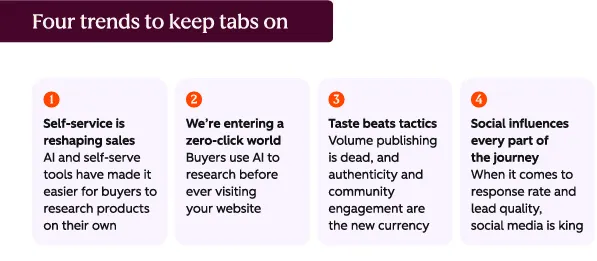

HubSpot has collaborated with Reddit to release a new guide for B2B marketers on leveraging the platform effectively, especially as AI chatbots increasingly source information from Reddit. The guide aims to help brands combat declining search referral traffic and enhance their presence where potential buyers and AI models are gathering information. It covers the evolving B2B buying journey, the impact of AI, and practical advice on utilizing Reddit's communities and ad tools for maximum impact.

Jan. 5, 2026 •

Somewhat-Bullish

D-Wave Quantum stock saw significant gains today, rising 8.9% amidst a bullish tech market, particularly in quantum computing and AI. The company's quantum-annealing approach and strong balance sheet with $836 million in cash make it a notable player in the nascent quantum computing space. However, due to high volatility and early-stage technology, the stock is best suited for investors with a high risk tolerance.

Jan. 5, 2026 •

Neutral

Shares of Lockheed Martin (NYSE: LMT) rose 3.5% due to heightened geopolitical tensions in Venezuela, prompting a rush into defense stocks. While such events often boost defense sector interest, the article notes that investors must scrutinize whether this translates to sustainable margin growth and successful program execution, especially given past issues with fixed-price development programs. The author stresses that Lockheed's long-term performance hinges on demonstrating consistent profitability, beyond short-term geopolitical impacts.

Jan. 5, 2026 •

Bullish

Hasbro Inc. (HAS) stock reached a 52-week high of $85.25, reflecting a 49.32% increase over the past year and an actual one-year return of 51.9% according to InvestingPro data. This surge is supported by positive analyst ratings, strategic initiatives including a new video game division, and strong performance in Magic: The Gathering. Despite being slightly overvalued, the company offers a 3.37% dividend yield and a 45-year streak of dividend payments.

Jan. 5, 2026 •

Neutral

Verizon is launching "The Ultimate Super Bowl LX Experience" sweepstakes, offering customers a chance to win an all-expenses-paid trip to Super Bowl LX with VIP on-field access, game tickets, travel, and accommodations. The sweepstakes runs from January 9-18, 2026, with winners notified by January 23, 2026. Additionally, customers can claim game-day tickets via Verizon Access on a first-come, first-serve basis from January 9-11, and participate in other experiences like virtual player meet-and-greets.

Jan. 5, 2026 •

Neutral

Pool Corporation (NASDAQ: POOL) experienced a significant stock drop in 2025 due to slow revenue growth, and faces challenges in 2026 as consumers are feeling financially strained. The company, which primarily sells pool-related products and services, needs higher growth rates, potentially from international expansion, to justify a stock rally. However, North American sales still dominate, and improving domestic sales will be crucial despite economic headwinds.

Jan. 5, 2026 •

Somewhat-Bullish

Beamr Imaging Ltd. (BMR) has outlined its 2026 execution strategy following a landmark 2025 where it validated its video compression technology across autonomous vehicle (AV), artificial intelligence (AI), and media workflows. The company aims to transition from validation to strategic production-scale deals with global "lighthouse" customers, converting existing pipelines into deployments. Beamr's 2025 achievements included entering the autonomous vehicle market and expanding AI workflow applications, while 2026 will focus on commercial growth in data-centric video solutions.

Jan. 5, 2026 •

Somewhat-Bullish

Amazon (AMZN) stock shows fundamental strength with a "Strong Buy" rating despite recent headwinds from an AI-induced sell-off. Key growth drivers include AWS, AI, and advertising sales, and analysts project significant upside potential for the stock in the next year. The company's expansion into robotics and grocery, alongside its robust institutional investor support, indicates continued optimism for its long-term performance.

Jan. 5, 2026 •

Somewhat-Bearish

Vietnam has ordered Netflix to remove the Chinese television series "Shine on Me" from its streaming platform in the country. The removal was prompted by scenes in the drama that depict a map featuring the "nine-dash line," which Vietnam asserts violates its national sovereignty in the South China Sea. This action highlights ongoing territorial disputes and their impact on media content distribution.

Jan. 5, 2026 •

Neutral

This article provides a comprehensive guide on how to cancel a Fubo TV subscription across various platforms, including the website, Roku, Apple, and Google Play. It details the steps for each cancellation method, outlines Fubo's different subscription plans and their costs, and addresses frequently asked questions about the service, such as free trials, refunds, and reactivation. The guide aims to simplify the process of ending a Fubo plan for users who decide the service no longer meets their needs.

Jan. 4, 2026 •

Somewhat-Bearish

Netflix shares closed down about 3% at $90.99, underperforming the market, as investors remained cautious about the streaming company’s pending Warner Bros deal. The stock is near both its 52-week low and below its 52-week high, with regulatory and financing questions surrounding the acquisition creating volatility. Netflix's upcoming Q4 earnings on January 20th and economic reports on January 5th, 7th, and 9th are key catalysts for investors.

Jan. 4, 2026 •

Neutral

Guidewire Software (GWRE) stock fell 6.7% on Friday, closing at $187.63, following a sharp slide on the first trading day of 2026. This drop pushed GWRE below its 50-day and 200-day moving averages, with its RSI indicating "oversold" conditions, prompting investors to watch for a technical reset. Upcoming catalysts include U.S. jobs and inflation data this week, and Guidewire's next earnings report in early March, as the company navigates its cloud transition and investors assess its annual recurring revenue and fiscal-year outlook.

Jan. 4, 2026 •

Somewhat-Bearish

Netflix (NFLX) shares dropped nearly 3% on Friday, closing at $90.99, as investors continue to weigh the proposed acquisition of Warner Bros. Discovery’s studios and streaming assets. The upcoming fourth-quarter earnings report on January 20th and a rival bid from Paramount Skydance for Warner Bros. Discovery are key factors influencing the stock. The ongoing takeover battle raises questions about leverage, regulatory approvals, and the deal's timeline.

Jan. 3, 2026 •

Somewhat-Bearish

Netflix stock fell 3% on Friday, closing at $90.99, as investors remained focused on the company's planned $72 billion acquisition of Warner Bros. Discovery assets. Upcoming catalysts include Netflix's fourth-quarter earnings report and business outlook on January 20, as well as a packed U.S. economic data calendar next week. The decline reflects investor unease over deal risk and regulatory scrutiny, keeping pressure on the stock ahead of key financial updates.