Dec. 23, 2025•

Somewhat-Bearish

The J. M. Smucker Company (NYSE:SJM) has a P/S ratio of 1.2x, which is higher than nearly half of companies in the Food industry. Despite this investor optimism, the company's revenue growth has been lacking, growing only 2.7% per annum over the next three years, similar to the broader industry's forecast of 2.3%. This disparity suggests that investors might be overpaying for SJM given its modest growth outlook.

Dec. 23, 2025•

Neutral

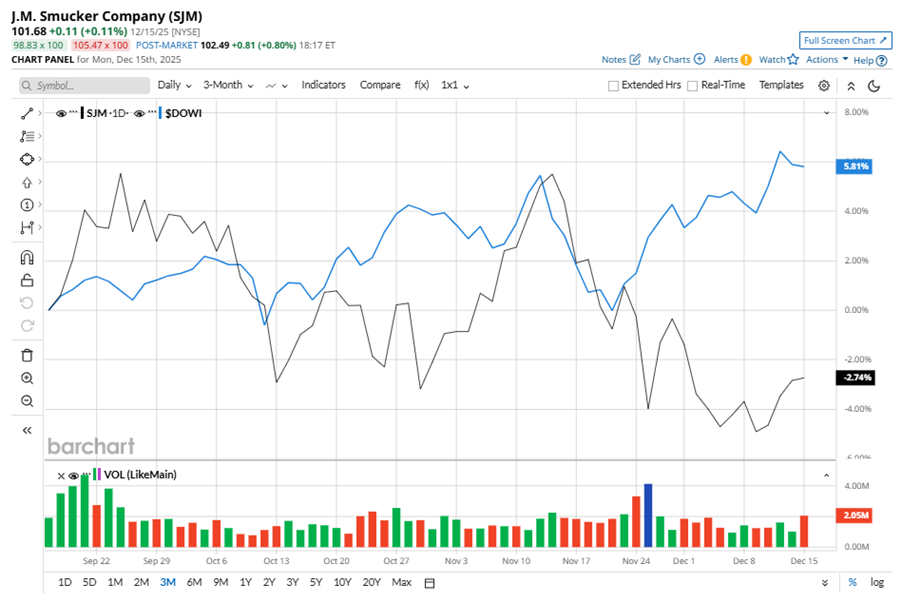

This article provides live stock price, charts, and news for The J. M. Smucker Company (SJM). It includes real-time trading data, key financial fundamentals, and historical performance metrics. The company profile highlights Smucker's position as a major player in the food and beverage sector with a focus on North American market dynamics.

Dec. 20, 2025•

Somewhat-Bearish

J.M. Smucker Co. stock underperformed on Friday compared to its competitors. The article mentions Unity Software's fourth-quarter financial results, reporting a 35% year-over-year revenue increase to $609 million, exceeding estimates, despite a quarterly loss of 66 cents per share. Full access to the news requires login or account creation due to copyright issues with Dow Jones.

Dec. 20, 2025•

Somewhat-Bullish

Cyndeo Wealth Partners LLC has made a new investment in The J. M. Smucker Company (NYSE:SJM) by purchasing 78,279 shares valued at approximately $8,501,000 during the third quarter. This acquisition gives Cyndeo Wealth Partners LLC approximately 0.07% ownership of J. M. Smucker. Other institutional investors have also adjusted their positions in the company, with hedge funds and institutional investors collectively owning 81.66% of the stock.

Dec. 20, 2025•

Neutral

This article provides a comprehensive overview of General Mills, Inc. (GIS) stock, including its latest price, financial metrics, insider transactions, and a list of recent news and analyst ratings. It highlights key financial data such as market capitalization, P/E ratio, dividend yield, and performance metrics over various periods, alongside recent analyst actions and company news.

Dec. 20, 2025•

Somewhat-Bullish

J. M. Smucker (SJM) has received a sentiment boost due to positive updates on its Sweet Baked Snacks and Hostess brands, improved coffee margins, and stronger long-term earnings estimates driven by Uncrustables growth. Despite these positive developments, the stock remains under pressure, trading at $98.69 against a narrative fair value near $116, suggesting it may be undervalued. The company's future PE of 17.2x on 2028 earnings is lower than the US Food industry average of 19.5x, hinting at potential for a valuation reset.

Dec. 19, 2025•

Bearish

J.M. Smucker Co. (SJM) stock fell 1.67% on Friday, closing at $98.69, while the broader market saw gains. The S&P 500 Index rose 0.88%, and the Dow Jones Industrial Average increased by 0.38%. This marked the second consecutive day of losses for J.M. Smucker Co. shares.

Dec. 19, 2025•

Somewhat-Bullish

Natural Grocers has launched a new line of private-label grass-fed beef sticks and bites, expanding its portfolio of Natural Grocers Brand Products. These new snacks, available in original and jalapeno flavors, adhere to the company's "Commitment to Quality" principles, ensuring traceability, non-GMO, gluten-free, and minimally processed attributes. The introduction of these products reflects Natural Grocers' dedication to providing customers with quality, transparency, and affordability in alignment with their family values.

Dec. 19, 2025•

Neutral

Gradient Investments LLC has made a new investment in The J. M. Smucker Company, acquiring 128,064 shares valued at approximately $13.9 million. This new stake represents about 0.12% of the company, while CFO Tucker H. Marshall recently sold a significant portion of his holdings. Analyst ratings are mixed, with a consensus "Hold" and an average price target of $116.79.

Dec. 19, 2025•

Neutral

Assenagon Asset Management S.A. significantly increased its stake in The J. M. Smucker Company (SJM) during the third quarter, boosting its holdings by 811.0% to 919,139 shares. This comes as Smucker reported mixed Q3 earnings, missing EPS estimates but exceeding revenue expectations, and issued FY2026 guidance below sell-side consensus. The stock currently offers a 4.4% dividend yield and has seen various analyst rating changes amidst insider selling by the CFO.